COVID-19

COVID-19

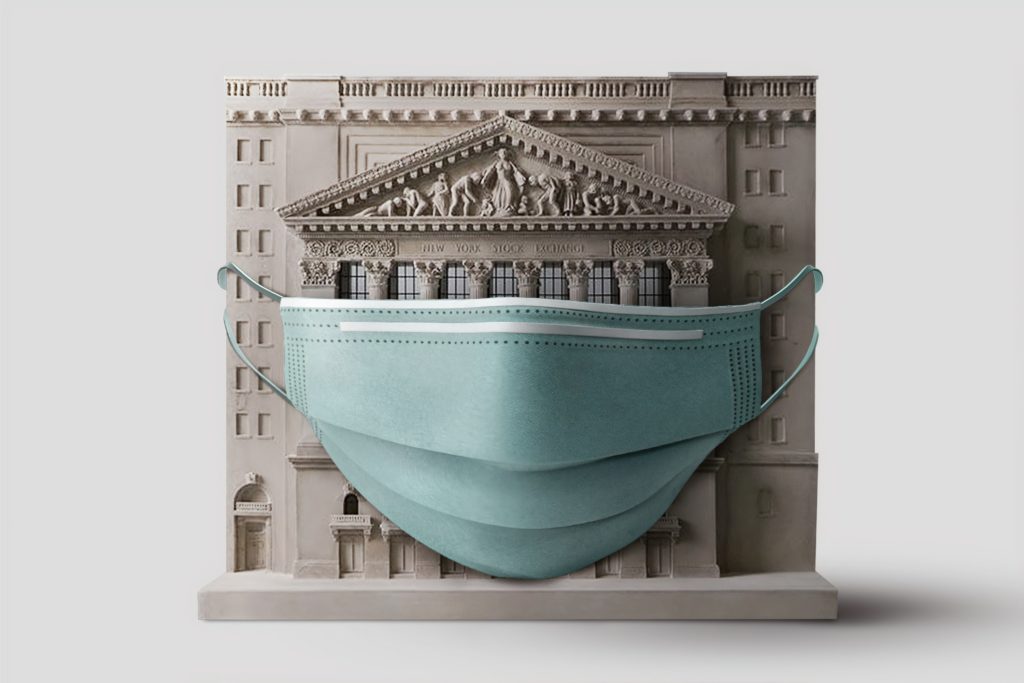

The Impact of COVID-19

The number of businesses across Australia affected by COVID-19 now measure into the thousands and Sydney was not immune. Many people, from employees to company CEOs and everyone in between have been exploring the need for legal support during difficult financial times as a result of the pandemic.

The effects of COVID-19 have been evident thanks to research conducted by the Australian Bureau of Statistics has had tracked the effects of the pandemic since March; the impact on businesses, wages and commercial activity has been far-reaching and expected linger months, even after the number of infected cases decrease and commercial activity slowly returns to normal.

During April and May, at the height of the mandatory social distancing restrictions across Australia, payroll jobs fell 1.1% in late April and early May after falling more than 7% in March. This was because, perhaps unsurprisingly, businesses were forced to reduce their operating hours, limit their customer interactions, temporarily close their doors or, in the most extreme cases, close down forever. The lack of revenue meant operating costs needed to go down, and workers were some of the earliest victims. For example, the total reduction in employee jobs in the accommodation and food services industry deteriorated from -25.6% to -33.4%

According to ABS’ Business Impacts of COVID-19 Survey, businesses were not only forced to reduce their workforce to stay solvent. The survey showed 55% of businesses were accessing government support, including wage subsidies and in March-April, many businesses have also been forced to restructure their business model to stay afloat. Two in five businesses (38%) have changed how they deliver their products or services, including shifting to online services, and over a third of businesses have renegotiated their lease and rental arrangements and a quarter have deferred loan repayments.

Those who have families were reported to have been forced to change their work arrangements to care for their children, including working from home (38%), reducing or changing working hours (22%), and taking leave from work (13%).

Australia’s retail turnover declined by 17.9% in April due to the unrelenting pandemic restriction. Contributors to this decline included a 17.1% fall in the food services industry and continued weakness in turnover for cafes, restaurants and takeaway food services, at around half its level in April 2019.

Temporary Legislation Changes

Directors of insolvent companies who fail to comply with regulations under the Corporations Act 2001 (Cth) may face a number of penalties. Fortunately, in light of COVID-19, the Australian Government has recognised that the global pandemic has made personal and corporate insolvency cases less straight forward. That is why, earlier in 2020, temporary legislation changes were introduced to support those who may have been capable of handling insolvency matters if not for COVID-19.

All temporary changes will be effective for six months from the date of their release.

New creditor thresholds and deadlines

As of 25 March 2020, debtors have been given more time to respond to creditors, with higher thresholds before any statutory demands can be made on a company.

So what do these changes mean?

As a result of the economic effect of the COVID-19 pandemic, the new minimum threshold for creditors issuing a statutory demand on a company is now $20,000, and debtors will also have an increased deadline of six months to respond.

Traditionally, the minimum threshold for creditors to issue the demand is $2,000 under the Corporations Act 2001 (Cth), and a debtor whose company was issued a demand has 21 days to respond.

Not responding to a demand within the specified time creates a presumption that the company is insolvent.

Bankruptcy Notices

From 25 March 2020, the Australian Government introduced temporary changes to the current bankruptcy legislation that will be in effect for six months.

According to the Australian Financial Security Authority:

- The debt threshold for creditors to apply for a Bankruptcy Notice against a debtor will increase from $5,000 to $20,000.

- A debtor has up to six months to respond to a Bankruptcy Notice before a creditor can commence bankruptcy proceedings, instead of 21 days.

- If an individual debtor applies for voluntary bankruptcy after 25 March 2020, they are protected against unsecured creditors who cannot take further action against them for six months.

However, if a bankruptcy notice was issued before 25 March 2020 the original legislation applies and the you will have 21 days to comply.

Protection from Insolvent Trading

On 24 March 2020, the Corporations Act 2001 (Cth) provisions were temporarily amended to protect company directors from personal liability from insolvent trading.

The amendment provides a new safe harbour from the directors’ duty to prevent insolvent trading and was introduced in response to the growing number of businesses facing insolvency as a direct result of the economic effects of COVID-19.

Under the amendments, companies that may be at risk of insolvency in the wake of COVID-19 can continue to operate and incur debts ‘in the ordinary course of the company’s business’, without the fear of being punished for insolvent trading.

The safe harbour will be effective for six months from its introduction.

To be able to rely on these measures, the debt incurred must be:

- In the ordinary course of the company’s business;

- During the six-month period commencing from 25 March 2020; and

- Before any appointment of an administrator or liquidator during the temporary safe harbour application period.

- During the six-month period in which the temporary relief is offered, businesses have a better chance to resume normal operations when the pandemic has passed.

What do these changes mean?

If your company is facing insolvency as a result of COVID-19, this new safe harbour may provide an adequate opportunity to review your company’s position before developing a turnaround strategy or pursuing voluntary administration. The temporary period may also give your company the time it needs to reclaim former business activity, enabling you to return to normal operations and start paying back debts.

Remember – even though there is now temporary relief from the insolvent trading provisions, that relief does not apply to a director’s duties under statutory and common law.

It is still vital that company directors:

- Act in the best interests of the company as a whole;

- Act with care, diligence and good faith; and

- Do not use their position or information obtained as a director to gain an advantage or cause detriment to the company.

Digital Meetings and Agreements

On 6 May 2020 Treasurer Josh Frydenberg released Corporations (Coronavirus Economic Response) Determination (No. 1) 2020 which amends the Corporations Act 2001 (Cth).

Under the new Determination:

- Meetings (like AGMs) may be held using one or more technologies that give everyone entitled to attend a reasonable opportunity to participate without being physically present in the same place.

- A company may execute an electronic document without using a common seal, as long as signatories clearly identify themselves and their intention in respect of the contents of the document in electronic communication. Signatories can alternatively sign a physical copy of the document.

Signing documents

If your company goes into liquidation and your movements are restricted by social distancing regulations, under the Determination you can execute an electronic document and without a common seal, as long as:

- Each person required to sign the document on behalf of the company signs a physical copy or counterpart of the document; or

- Signatories use electronic communication which suitably identifies them and indicates their intention regarding the document’s contents.

You can sign documents by:

- Pasting a copy of a signature into a document;

- Signing a PDF on a tablet, smartphone or laptop; or

- Using cloud-based signature platforms.

Copies, counterparts or electronic communication must include the entire contents of the document, but signatories do not need to sign the same physical document. Instead, a document could be signed and scanned by the first signatory and then printed and signed by the second signatory, or separate electronic signatures could be applied to fully electronic versions of the document.

Meetings

The Determination also ensures that companies that are required to or wish to hold a meeting, such as a creditors meeting, may do so using technology rather than face-to-face meetings. The Determination enables a quorum, votes, notices and the asking of questions to be facilitated electronically.

The Determination also allows for information required for the meeting to be circulated and accessed electronically.

The new Determination is a temporary measure which will be in effect for six months and will expire on 5 November 2020.

What do these changes mean?

The requirement for social distancing has obviously made it tough for organisation directors, creditors and liquidators to meet, or for several signatories to sign the same physical file without delay. This new determination will carry new validity to virtual practices, giving companies a level of reassurance that their officers’ roles and obligations in isolation have the equal legitimacy as conventional ‘ink and pen’ business practices.

Essentially, if your insolvent company is placed into voluntary administration and then moves to liquidation, you can rest assured that all steps of the liquidation process are valid and official, no matter where they are conducted.

Responsibility for Company Directors

If you are a director of an insolvent company, you are personally liable for ongoing trading and therefore responsible for increased debts incurred during insolvency.

However, the Government’s temporary changes to legislation relieves any liability to directors for incurring debts during the ordinary operations of their business. This means that directors are absolved from personal liability that would otherwise be associated with the insolvent trading, providing an opportunity for their company resume normal operations when the COVID-19 crisis has passed.

The relief of personal liability should not be seen as a ‘get out of jail free’ card. The relief only applies to debts incurred in the ordinary course of the company’s business, and all debts incurred must still be paid. Any cases of dishonesty and fraud during this period are still against the law and will be subject to criminal penalties.

Ultimately, the updates to legislation were introduced to reduce the harsh ramifications of insolvency, as it is understood that COVID-19 has resulted in unforeseen circumstances that could affect even the healthiest of businesses.

For more information about your rights and obligations during COVID-19

Contact Insolvency Lawyer Melbourne for the support you need.